Buyer Protection

Authenticity guarantee

Buyer Protection

Authenticity guarantee

Checkout our exclusive Categories

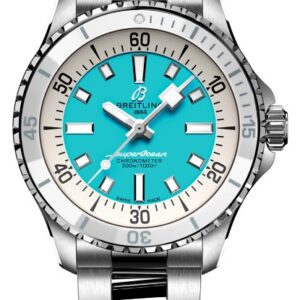

Men’s Most Popular Products

Grand Seiko SLGA021G Watch

$10,890.97

Grand Seiko SBGY009G Watch

$8,984.59

Grand Seiko SBGE283G Watch

$9,725.96

Checkout our exclusive Categories

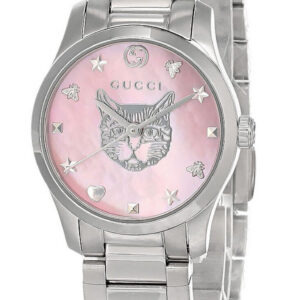

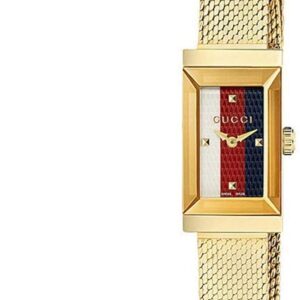

Women’s Most Popular Products

Panther Necklace 5.1ct 18k White Gold

$7,980.00

18K Gold Bangle 32 – 33g No Diamonds

$4,020.00